Construction showing resilience and growth

By Adam Freill

Construction InfrastructureRICS first-quarter survey indicates cautious optimism in the construction sector as inflation slows and material prices settle.

Despite having to navigate its fair share of challenges, infrastructure is driving the country’s construction sector, according to the Q1 2023 Canadian Construction Monitor report released by the Royal Institution of Chartered Surveyors (RICS). The quarterly guide looks at trends in the construction and infrastructure markets.

Overall, the first-quarter report is generally positive, although its authors point at the impact of the macro environment, including: Canada’s inflation rate slipping to its lowest level since the middle of 2021, the Bank of Canada (BoC) responding by pausing its rate tightening cycle, and workload trends that remain solid despite labour shortages being cited as a major problem. The outlook on profits remains cautious, however as prices continue to rise.

“After months of receiving deflating news about the rising inflation and how Canada may be sliding into another recession, it was uplifting to read the Bank of Canada Monetary Policy Report – April 2023, where the BoC forecast that the inflation rate will fall to three per cent by mid-2023, with Canada reaching its two per cent target by end of 2024,” commented Shelia Lennon, CEO of the Canadian Institute of Quantity Surveyors. “This runs in line with the Q1 2023 Construction Monitor Report survey results which paint an overall national picture of a cautiously optimistic 12-month profit forecast, and a continued rise in infrastructure workloads despite continued supply chain problems and labour shortages.”

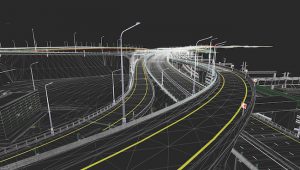

According to the survey, infrastructure continues to drive the wider construction sector. More than a third of survey contributors are seeing current workloads rising, which is broadly in-line with the results of recent quarters. The workload trend is solid across the infrastructure sub-sectors, as was the case previously, but the component with the most momentum is transport.

The key takeaway, says RICS, is that infrastructure activity is set to remain strong over the next year. That said, there is a little more positivity from respondents regarding both private residential and non-residential work notwithstanding the potential for the economy to continue to flirt with recession over the coming months and year.

Perhaps not surprisingly, labour shortages remain a key challenge. The proportion of contributors to the latest survey identifying labour shortages as a problem was almost 80 per cent. This is little different from the Q4 result, but in the last survey before the onset of Covid, just under 60 per cent of respondents took this view.

In the construction industry, there is a positive outlook for profits over the next 12 months. Survey respondents expect tender prices and construction costs to increase by five to six per cent. And while the growth of material costs seems to be slowing down, these costs along with skilled labour costs are still expected to be a key factor that may hinder profit margins.